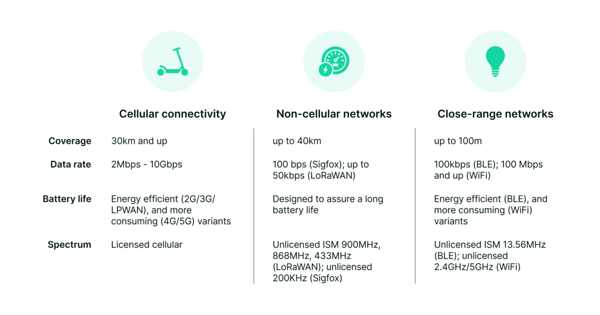

As the IoT economy explodes, so does the need for constant connectivity. Manufacturers have to decide how to connect their devices, and choosing the right connectivity can be difficult. With so many options to choose from, it is vital that you consider your IoT project goals before selecting your communication technology.

An insight into cellular network industry

According to MarketsandMarkets research, the cellular IoT market is projected to grow from USD 3.9 billion in 2021 to USD 15.4 billion by 2027; it is expected to grow at a CAGR (Compound Annual Growth Rate) of 25.7% from 2021 to 2027. The growth is expected to be mainly driven by the increasing deployment of cellular IoT modules in smart city infrastructure and building automation. There’s also a growing demand for cellular IoT in agriculture and environmental monitoring.

East Asia, Western Europe, and North America currently account for around 2/3 of the global cellular IoT devices base. However, future growth will be driven by Asia Pacific region countries with China, Japan, India, and South Korea as the major contributors.

Technologically, the cellular connectivity landscape is changing rapidly. The so-called legacy networks are being replaced by the newer technologies of 4G and 5G. This process is called “Network Sunsets” and we have covered it thoroughly in our blog. The US market is gradually abandoning 2G and keeping 3G/4G, while Europe is losing 3G and keeping 2G/4G.

As a response to the problem where mobile networks were not optimized for a large number of devices in a small area, technologies of LTE-M and NB-IoT were introduced. LTE-M and NB-IoT are low-power wide-area networks (LPWAN) designed for the Internet of Things (IoT), keeping in mind that a considerable amount of IoT deployments use a minimal amount of data per month.

Choosing between all the possible options today can be tricky, therefore we have created a guide to help you in the process.We've also answered common questions about the specifics of IoT connectivity and the critical elements that make it all work.

Non-cellular long-range networks

Sigfox

Sigfox is a global network operator focused on building wireless networks to connect low-power objects (electricity meters and smartwatches) to the Internet. Sigfox is considered an LPWA network, like NB-IoT, LTE-M, and LoRaWAN.

In comparison to other LPWA networks, Sigfox is most similar to NB-IoT for its ultra-narrowband connectivity.

Data transfer bandwidth – Sigfox supports up to 140 uplink messages (up to 12 bytes) at a speed up to 100 bits per second and can download only four 8 byte messages a day. Comparing it to NB-IoT, it is very limited even for an ultra-narrowband network.

Connectivity range – Sigfox provides a wide-range cellular coverage of up to 40 km (in rural areas, the coverage stays around a few km in cities). Here it’s important to keep in mind that you only have the connectivity where an existing Sigfox network is already set up and the bandwidth frequency is fixed per location.

Even though Sigfox offers a very slow data transfer rate, it might be just enough for some use cases, mainly smart metering, air quality monitoring, and weather stations. Another thing to consider is that Sigfox is developed and promoted and developed by one private company, so if anything happens to the company, it might have an impact on the connectivity service.

LoRaWAN

LoRa (Long Range) is a spread spectrum modulation technique derived from chirp spread spectrum (CSS) technology. LoRaWAN is a network protocol that defines the operation of LoRa devices in a wide area network (LPWAN). LoRa and LoRAWAN have become the main non-cellular LPWAN solutions.

LoRa provides long-range connectivity with low power consumption to sensors and other connected devices. The modulation supports bitrates ranging from 0.3 kbps to 50 kbps, but the real data rate is strongly dependent on the environment.

Coverage – Even though the LoRa Alliance networks have a longer history in IoT deployment than more recent cellular standards, the technology is not as widely spread as the cellular networks. Setting up new LoRaWAN network infrastructure can be costly and slow, with challenges such as backhaul provisioning and planning permissions, especially in urban areas.

Roaming – The challenges in creating reliable frameworks between different network operators means there’s limited roaming between networks, and roaming between different types of networks can create significant reliability and security risks. Roaming between cellular networks for IoT devices, however, is very common and can even be avoided nowadays with the more mainstream adoption of eSIM (eUICC).

Just like with other LPWAN technologies, LoRaWAN is a low-cost long-range network, designed for mainly uplink-oriented low traffic applications.

Close-range wireless networks

Wi-Fi

The debate between using cellular connectivity and WiFi is ongoing and many-faceted, with each having its advantages and disadvantages.

There are several essential differences between WiFi and cellular connectivity. While researching the best networking solution for your application, it is important to consider these factors:

Wireless range – One of the main advantages cellular connectivity has over WiFi is its range. WiFi’s connectivity depends largely on how far the device is from the router and if there are any obstacles (thick concrete walls, multiple floors, etc.) between them. Cellular connectivity doesn’t require a router and the devices can connect from anywhere there’s a cellular signal.

Data plans – Cellular connectivity data plans for IoT may be limited to a certain amount of MBs per month or expensive in the long run. In that case, WiFi would be the better option, because there are no cost limitations on the amount of data transferred.

Data security – Generally, cellular IoT connections are more secure than Wi-Fi connections because data is always encrypted — even when it is not being used. In contrast, most Wi-Fi connections allow users to switch off the encryption when it is not absolutely necessary (for example, on their home network).

Therefore, we can conclude that Wi-Fi would work better in more static environments, where the devices make a lot of data (for example, touch-screen podiums in restaurants). Cellular connectivity will be a more reliable option for more mobile use cases.

Bluetooth

Bluetooth is generally associated with consumer electronics – laptops, smartphones, headphones, etc. The technology was designed to create personal area networks and establish a connection between two devices close to each other.

In the IoT world, a more energy-efficient BLE (Bluetooth Low Energy) is being used. Compared to classic Bluetooth, the BLE provides considerably reduced power consumption and cost, while maintaining a similar communication range.

Data transfer speed – BLE can transmit small packets of data at a speed up to 1 Mbps. The amount and speed are enough to transfer numerical values from sensors, for example, but BLE cannot transfer data in real-time.

Coverage – BLE radio signals can be received by a device of up to 500 meters. This range can be extended by Bluetooth Mesh technology using the relay nodes. The system operator can then decide how many hops a message could take to reach the destination.

Data security – Even though Bluetooth has gone through significant upgrades in security with its newest version, it still doesn’t enable data encryption or additional security applications.

Overall, BLE is a good option for applications to the long battery life possible for “always-on” devices, for example, proximity sensors (like iPhone’s “Find my device” app), sports and fitness sensors, and blood glucose monitors in healthcare.

Zigbee

Zigbee is a specification based on an IEEE 802.15.4 personal-area network standard and is considered to be an alternative to BLE and WiFi for home applications. Zigbee does not focus on point-to-point communication, but it operates in a mesh network.

Coverage – Its low power consumption limits data transmission distances to up to 100 meters line-of-sight, though it can reach longer distances through its mesh network solution. The upside of using a mesh network is, that if one node fails for some reason and can’t communicate with another on the network, the master node and second node may communicate by linking to a third node within range – all nodes co-operate in the distribution of data.

Security – With the release of Zigbee 3.0, the connection security is enhanced significantly. The methods of security used are centralized (a coordinator or trust center forms and manages the allocation of the network, and links security keys to joining nodes) and distributed (security is formed by a router, and any Zigbee router node can subsequently provide the network key to joining nodes).

A typical example of a Zigbee use case would be a Zigbee-enabled light bulb that is controlled by a Zigbee-enabled light switch. They may be made by different manufacturers, but as they’re both using Zigbee, there’s no barrier of communication between the two.

Conclusion

Despite the fact that WiFi, Bluetooth Low Energy, and other low power technologies can offer a solution to IoT connectivity problems in some geographical areas, the bottom line is that cellular networks remain the de-facto standard for IoT data connectivity.

The main reasons for choosing the cellular connectivity for your next IoT solution are:

- global coverage (incl rural areas)

- reliable connection quality

- well-supported by most hardware/modems.

For further questions on how to get your IoT devices connected to cellular networks, contact sales@1oT.com, and we’ll find the best solution for you.